45l tax credit extension 2022

The 45L Credit is set to expire at the end of 2021. The Arkansas homes were built in Zone 3 to 2012 IRC minimum code and 2014 Arkansas Energy Code for New Building Construction.

45l Energy Efficient Tax Credits Engineered Tax Services

Congress has wrapped its 2021 session and will not resume again until January when the next Congressional.

. The tax credit amount. To access your free listing please call 1833467-7270 to verify youre the business owner or authorized representative. The bill extends the.

Arkansas Home Builder sold 35. Except as provided in paragraph 2 the amendments made by this section amending this section shall apply to dwelling units acquired after December 31 2022. No cash may be dropped off at any time in a box located at the front door of Town Hall.

Please join us as we update you on IRS changes with the RD Tax Credit and the future of the 45L Tax Credit. Tax Credits Iowa LLC is located at 462 2nd Ave Piscataway NJ 08854. Originally having expired at the end of 2021 45L tax credits have been retroactively extended for 2022 through the end of.

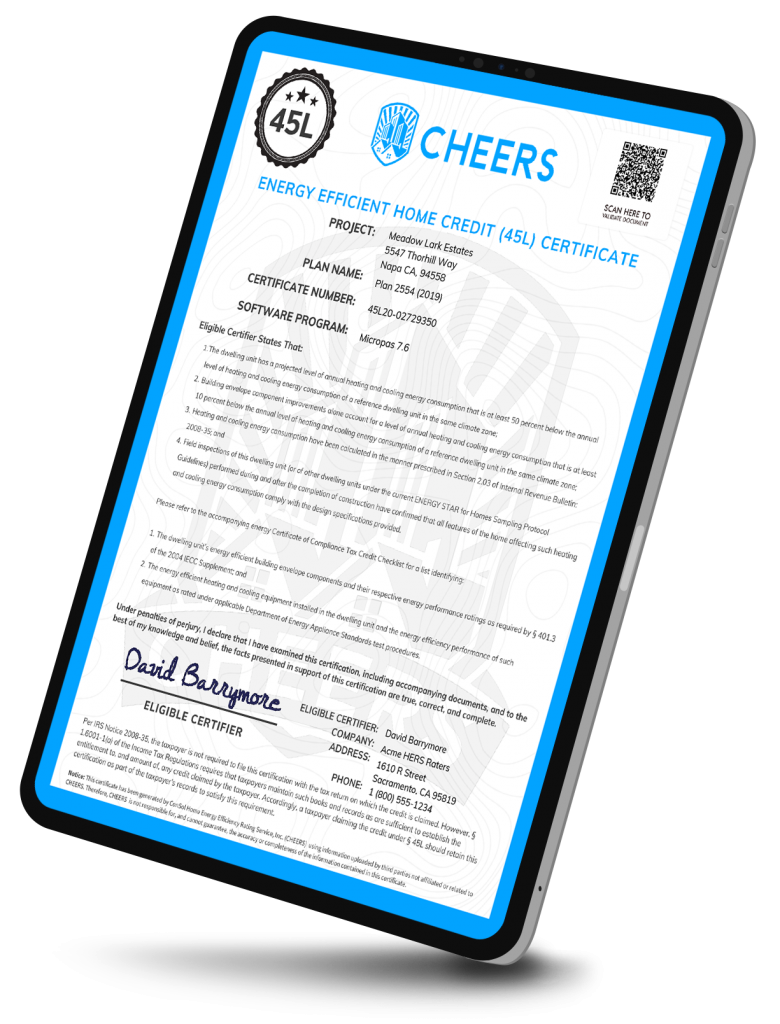

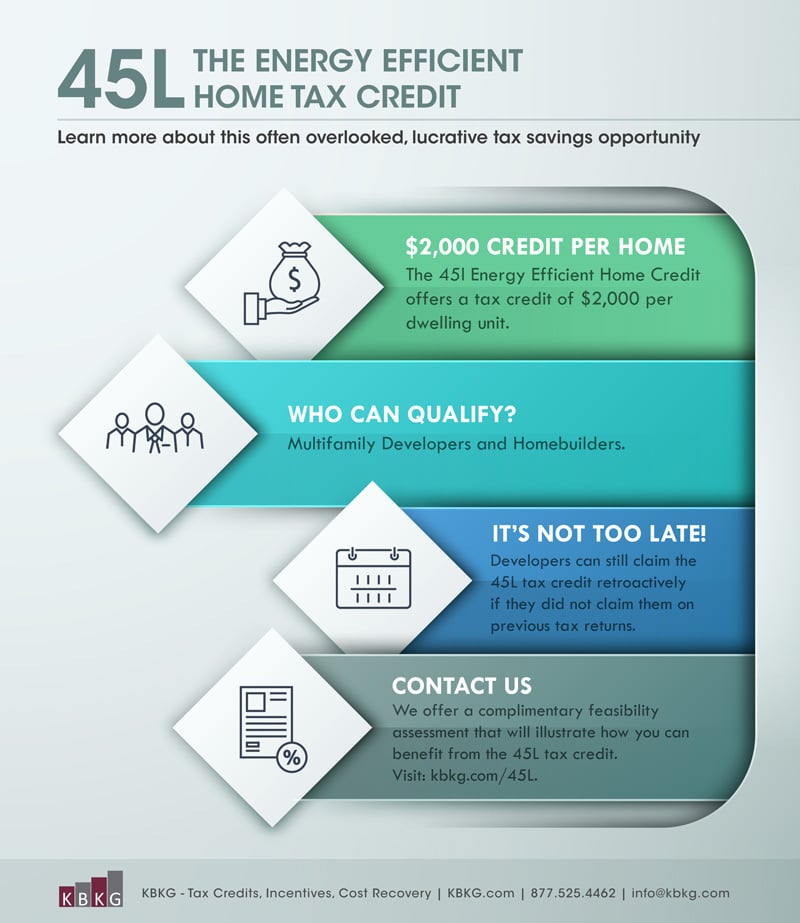

Tax and sewer payments checks only. The energy-efficient home credit provides developers a tax credit of up to 2000 per qualifying unit if they can certify the energy-saving qualities of the residence. The proposal would increase the section 45L tax credit for an energy efficient home from 2000 to 2500 and extend the tax credit five.

The 45L tax credit for builders is included in the Inflation Reduction Act of 2022 which will be voted on soon. Congress Defers on 45L Energy Tax Credit in BBB Act until 2022. To pay your sewer bill on line click here.

The Inflation Reduction Act of 2022 introduced in the Senate yesterday July 28 2022 will expand and extend the 45L Energy Efficient Home Tax Credit. Effective on January 1 2023 the following changes will be made to the tax credit. The new 45L Tax Credit - if the bill passes - will go into effect retroactively allowing builders to claim the credit for all 2022 homes.

Get Tax Credits LLC reviews ratings business hours phone. Tax Credits LLC can be contacted at 732 885-2930. Understand the 5 year amortization of expenses starting in.

The 45L Tax Credit is a Federal Tax Credit worth 2000 per dwelling unit that rewards multifamily developers investors and homebuilders that develop energy efficient. Extension Increase and Expansion of 45L Tax Credit. Additionally this bill proposes a.

Tax Credits LLC is located at 45 Knightsbridge Rd Piscataway NJ 08854. The existing language for the 45L tax credit was extended through December 31 2022. If your looking for Unclassified Establishments in Piscataway New Jersey - check out Tax Credits Iowa LLC.

The new energy efficient home credit as defined by Internal Revenue Code IRC Section 45L was extended increased and modified under the Inflation Reduction Act of 2022. The legislation is expected to pass and wil.

Inflation Reduction Act Business Tax Incentives Virginia Cpa

Inflation Reduction Act Extends Expands Section 45l Credit

Biden S 2022 Tax Proposals Bolster The 45l And 179d Energy Efficiency Tax Incentives Ics Tax Llc

Jessejenkins On Twitter There S More For Energy Efficiency Too Nothing Explicitly For Building Electrification Eg Heat Pumps Which Is A Bummer But Some Of These Efficiency Credits Could Apply To Heat Pump

45l Tax Credit Energy Efficient Tax Credit 45l

Eia Annual Energy Outlook 2022 U S Energy Information Administration Eia

45l Tax Credit Single Family Guide For More Money Back Southern Energy Management

45l Tax Credit Overview And Analysis Of The Residential Efficiency Energy

Eia Annual Energy Outlook 2022 U S Energy Information Administration Eia

Tax Updates For 2021 And 2022 Rodl Partner

Experts Explain 2022 Home Energy Federal Tax Incentives

45l Energy Efficient Home Tax Credit Extended For 2021 By Covid Relief Bill Green Building Law Update

Kbkg Tax Insight Bipartisan Bill Proposes Retroactive Extension And Updates To 45l Tax Credit Through 2022

45l Tax Credit What Is The 45l Tax Credit Who Qualifies

The Inflation Reduction Act Doubles The R D Credit Wilke Associates Cpas

Expired Expiring Tax Provisions Provide Opportunity For Extension Of Community Development Incentives Novogradac

Could We See A Federal Solar Tax Credit Extension In 2021 Solar Sam